Greece | Athens Golden Visa Program | The Hera Athens | Sepolia Region Real Estate Investment Ecosystem | Capitalization Potential and Strategic Market Analysis (2025-2030)

- M. Sami Akbeniz

- Dec 23, 2025

- 13 min read

Greece | Athens Golden Visa Program

This report presents a multi-faceted investment analysis of "The Hera Athens" project, developed in the Sepolia district, a strategically important area within Athens' urban transformation dynamics. The report covers a wide spectrum of data, ranging from global macroeconomic trends and local micro-location information to Greece's revised Golden Visa legislation (since 2025) and the project's architectural and financial technical specifications.

Our analysis shows that the Athens real estate market is entering a phase of maturation and diversification by 2025. In particular, the approaching saturation point of prices in the so-called "Tier 1" areas (Southern Suburbs, Historic Center) and the increase in the Golden Visa minimum threshold to €800,000 have shifted capital towards "value-oriented" and "development-oriented" areas. In this context, the Sepolia and Kolonos axis stands out as the areas with the highest growth potential in Athens' northwest corridor.

The Hera Athens project, with its "commercial-to-residential conversion" status, creates a rare arbitrage opportunity for investors, offering EU residency permits and high capital appreciation starting from €250,000. This report aims to shed light on investment decision-making processes by thoroughly examining the project's technical details, the gentrification process of the area, and financial projections.

Chapter 1: Macroeconomic Framework and Outlook for the Greek Real Estate Market in 2025

1.1. Economic Recovery and the Leading Role of the Real Estate Sector

The Greek economy has steadily recovered from the effects of a decade-long deep debt crisis and the subsequent pandemic shock since the early 2020s. By 2025, the country's economy is exhibiting growth above the Eurozone average. Key drivers of this growth include record increases in tourism revenues, foreign direct investment (FDI), and infrastructure spending from the European Union's Recovery and Resilience Fund (RRF).<sup> 1 </sup>

The real estate sector is at the heart of this economic renaissance. According to data from the Bank of Greece, housing prices increased nominally by 8.7% in 2024, while this increase reached 5.44% in real terms (inflation-adjusted).² This data proves that real estate continues to function as a strong hedge against inflation. In the first quarter of 2025, the urban housing price index increased by 6.19% year-on-year , indicating that the growth momentum is being maintained, but the market is evolving towards a more sustainable growth path.³

Foreign investor interest is the most important driving force of the market. Foreign direct investments focused on real estate, which reached €3 billion in 2023, maintained their strong performance in 2024 and 2025. Interest from American, Chinese, and Israeli investors, in particular, is concentrated on the Golden Visa program and commercial real estate opportunities. This capital flow finances not only the luxury segment but also the mid-range housing market and urban regeneration projects.

1.2. Inflation, Interest Rates and Purchasing Power Parity

While the European Central Bank's (ECB) interest rate policies affect the Greek mortgage market, the fact that a large proportion (over 80%) of real estate transactions in the country are financed with cash or equity makes the market resilient to interest rate shocks. Mortgage interest rates are expected to be in the 3%-5% range in 2025 , but for foreign investors, these rates are still manageable when compared to Euro-based rental yields (Yield).

Housing prices in Athens still present a significant "value gap" when compared to other European capitals such as Madrid, Lisbon, or Berlin. The average price per square meter in central Athens, ranging from €2,500 to €4,000, represents a high growth potential compared to other European metropolises where prices exceed €10,000.<sup> 6</sup> This situation keeps Athens in the "untapped value" category for international investors.

1.3. Supply-Demand Imbalance and Housing Stock

One of the main reasons for price increases in the market is the chronic shortage of supply. Construction activity, which came to a standstill during the decade-long crisis, prevented the creation of a new housing stock. Although there was a 31.8% increase in construction permits in 2024, it will take time for this new supply to enter the market. In particular , the supply of modern, earthquake-resistant housing with A+ energy efficiency ratings and social amenities is extremely limited. Projects like The Hera Athens target this shortage of high-quality housing, positioning themselves at a premium in the market.

Chapter 2: Legal Regulations and the Golden Visa 2025 Paradigm

2.1. Law 5100/2024: New Rules of the Game

The Greek government has made radical changes to the Golden Visa program in 2024 and 2025 in order to manage the housing crisis and distribute investments more evenly. These changes form the basis of The Hera Athens project's investment thesis.

The new system divides the country into three different tiers based on investment amounts:

Tier 1 (€800,000 Zone): The entirety of Athens (Attica region), Thessaloniki, Mykonos, Santorini, and islands with a population exceeding 3,100. In these zones, the minimum investment required to obtain a Golden Visa with a standard property investment has been increased to € 800,000.

Tier 2 (€400,000 Zone): All zones other than Tier 1. The minimum investment amount here is €400,000.

Special Exception Category (€250,000): This is the most strategic point of the law. Regardless of location (including central Athens and Tier 1 areas) , if the investment is in a "commercial-to-residential conversion" or "historical building restoration" project, the minimum investment amount remains fixed at €250,000 .

2.2. Strategic Importance of the "Conversion" Exception (Conversion Carve-Out)

The Hera Athens project is a project to convert a former commercial building (possibly an office or light industrial structure) into modern residential buildings. 10 This status exempts the project from the €800,000 investment requirement, allowing investors to enter the market in the heart of Athens from around €250,000.

This situation offers the following advantages for investors:

Capital Efficiency: Typing up €250,000 instead of €800,000 for the same residence permit means saving €550,000 in capital or using that capital for other investments (e.g., buying two different apartments).

Ease of Exit Strategy: Properties in the €250,000 range have significantly higher liquidity than luxury properties in the €800,000 range. If you wish to sell the property in the future, it will be at an accessible price point for both local buyers and other Golden Visa investors.

Arbitrage Opportunity: The fact that standard residential properties on the market are subject to an 800,000 Euro price limit will cause a surge in demand for renovation projects priced at 250,000 Euros. These limited-number projects will appreciate in value faster due to the imbalance between supply and demand.

2.3. The Ban on Short-Term Rentals (Airbnb) and Its Effects

The new law prohibits the rental of properties acquired under the "conversion" category within the Golden Visa program on short-term rental platforms (Airbnb, Booking.com , etc.). <sup>11</sup> Furthermore, using these properties as company headquarters is also prohibited.

While this restriction might seem negative at first glance, considering the Sepolia region and the nature of the project, it could turn into a strategic advantage.

Long-Term Rental Stability: The supply of long-term rental housing in Athens is extremely limited. With many homes in tourist areas now available through Airbnbs, locals, students, and expats are finding it difficult to find rental accommodation. The Hera Athens offers a high-quality solution to fill this gap.

Ease of Management: Long-term leases require less operational burden (cleaning, check-in/check-out, maintenance) and lower operating costs compared to short-term leases.

Income Security: 12-month contracts provide a regular and predictable cash flow unaffected by fluctuations in the tourism season. The 3% guaranteed rental yield offered by the project developer supports the sustainability of this model.

Chapter 3: Regional Depth - Urban Transformation of Sepolia and Kolonos

3.1. Historical and Geographical Context

Sepolia and Kolonos are historically significant areas located just northwest of the center of Athens, yet have long been neglected in the modern real estate market. Known in antiquity as "Kolonos Hippios" and the birthplace of Sophocles, the area also boasts a significant cultural heritage, being home to Plato's Academy (Plato's Academy Park) .

Geographically, it is located 2 km from Omonia Square, 2.5 km from Gazi-Technopolis, and approximately 3.5 km from the Acropolis. Its location at the intersection of major arteries such as Kifissos Boulevard (E75 motorway) and Lenorman Street makes the area one of the most accessible points in Athens in terms of logistics and transportation.

3.2. Transportation Network and Metro Integration (Connectivity)

Transportation, one of the most critical factors in real estate valuation, is Sepolia's strongest asset.

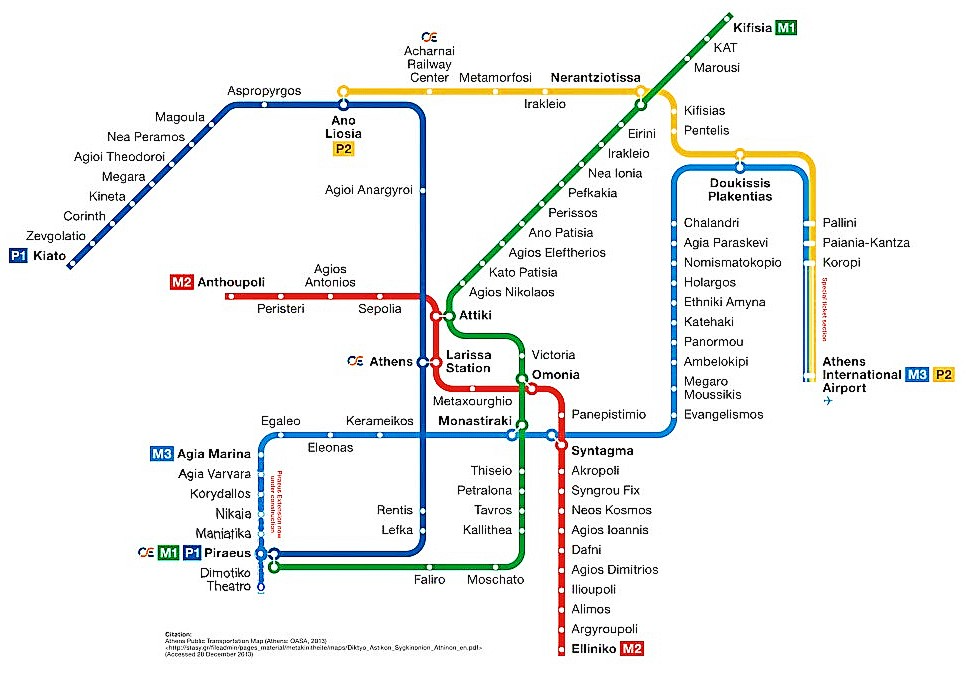

Athens Metro Line 2 (Red Line): Sepolia Metro Station is located in the heart of the area and is approximately 600-750 meters (8-10 minute walk) from The Hera Athens project. The Red Line is Athens' most strategic line; it connects directly to central points such as Omonia, Syntagma (Parliament), the Acropolis, and Syngrou-Fix. It also extends south to the Ellinikon project (former airport).

Attiki Station: Located adjacent to Sepolia, this station is the hub for Metro Lines 1 (Green) and 2 (Red). This allows for single-transit access to Piraeus Port and the northern suburbs (Kifissia).

Future Projection - Metro Expansions: The westward extension of Athens Metro Line 2 (towards Ilion) and the construction of the new Line 4 are strengthening the city's overall transport network and increasing the value of areas with metro access. 14 Sepolia will retain its importance as a central node in this network.

3.3. Gentrification Waves and the "Spillover" Effect

An examination of Athens' gentrification map reveals a wave spreading outwards from the center (Plaka, Monastiraki). Koukaki, Pangrati, and most recently Kypseli have all benefited from this wave, and prices have reached saturation. Investors and tenants are searching for "the next Kypseli," and data suggests that this area is the Sepolia-Kolonos axis.

Price Dynamics: Housing prices in central Athens increased by 27.4% year-on-year in the third quarter of 2025 , while in areas like Sepolia this rate of increase reached 38% (since 2019).17 The area is still 20-30% more affordable than Kypseli or Pangrati, indicating a high growth margin (upside potential).

Demographic Transformation: The area is evolving from a traditional working-class neighborhood to a bohemian (BoBo) structure favored by students, artists, and young professionals. Its proximity to the Athens University of Economics and Business (AUEB) and other private colleges keeps student demand high.

Votanikos Double Regeneration Project: In the Votanikos area, very close to Sepolia, a project is underway to build Panathinaikos' new stadium and a massive urban park. This project will completely transform the area's industrial identity, increase green spaces, and boost property values in the surrounding area (including Sepolia). 18

3.4. Street and Neighborhood Fabric

The area where Hera Athens is located has a mixed fabric, consisting mostly of mid-rise apartments built between 1970 and 1990, and older commercial buildings awaiting conversion. The streets are wider and more tree-lined compared to the busier center of Athens. In the 10th District, amenities such as supermarkets, pharmacies, bakeries, and local cafes are within walking distance. The area's "family-friendly" and "safe" nature is a significant factor in its appeal for long-term rentals.

Chapter 4: Project Analysis - The Hera Athens

4.1. Architectural Concept and "Adaptive Reuse" (Functional Transformation)

The Hera Athens is a project to preserve the skeleton of an existing commercial building (possibly a former office block or warehouse) and transform it into a fully modern residential complex. This method is called "Adaptive Reuse" and is one of the most valuable approaches to sustainability in modern urbanism.

Structural Advantages: Commercial buildings generally have higher ceilings, wider column spans (allowing for more flexible floor plans), and larger window openings than residential buildings. This will ensure that The Hera Athens apartments have a more spacious, bright, and modern feel than standard Athenian apartments.

Project Scale: Comprising a total of 56 apartments, the project is more of a medium-sized residential complex creating its own ecosystem rather than a boutique apartment building. 10

4.2. Apartment Typology and Target Audience Analysis

The project offers apartment types optimized to suit different investor profiles and tenant needs:

Compact Residence (1 Bedroom / 1+1):

Size: 40.00 m² - 46.00 m².

Features: Open plan kitchen, living area, bedroom, bathroom, and balcony.

Target Audience: Students, digital immigrants, single professionals.

Investment Analysis: These units offer the highest rental yield per square meter. Their low entry price makes them an ideal option for meeting the minimum €250,000 requirement for a Golden Visa (including additional costs).

Executive Residence (2 Bedrooms / 2+1):

Size: 54.46 m² - 92.00 m².

Features: 2 bedrooms, 1 or 2 bathrooms, large balconies, and spacious living areas.

Target Audience: Families with children, couples needing a home office, expat executives.

Investment Analysis: It appeals to the most stable tenant profile (families) in long-term rentals. It is also attractive for the local market in resale.

Garden Floor:

Features: Up to 28 m² of private outdoor living space.

Analysis: These are premium value units that create a "detached house" feel in the city center, especially for pet owners or garden enthusiasts. 10

4.3. Social Advantages: Competitive Advantage

90% of the housing stock in and around Sepolia consists of buildings with old elevators, no parking, and no social amenities. The Hera Athens creates an unparalleled "Luxury Residence" segment in the region with the facilities it offers:

Rooftop Thermal Pool: The opportunity to swim with a view of Athens is the biggest "X Factor" that sets this project apart from its competitors.

Gym (60 m²): A fitness area exclusively for building residents.

Lounge Area: A space for co-working and socializing.

Dedicated Storage Areas: 30 storage units.

Parking: Parking space for 30+ vehicles. Parking is a chronic problem in Athens; private parking increases rental value by 10-15% and also improves the liquidity of the property.

Energy Class A+: High insulation and efficient systems mean lower utility bills for tenants and preserved property value for investors. 10

Chapter 5: Financial Analysis and Future Projections (2025-2030)

5.1. Pricing and Valuation

According to the price list in the PDF document, apartments range from €250,000 to €365,000 . 10

Unit Price Analysis: Approximately in the range of €4,500 - €6,000/m².

Market Comparison: The price per square meter for second-hand apartments in Sepolia that require renovation is around €2,200 - €2,500. The price of 20 The Hera Athens is above the market average. However, there are rational reasons for this "Premium" pricing:

Golden Visa Leverage: The project allows for visa acquisition with a fee of €250,000 instead of €800,000. This provides the investor with a "opportunity cost" gain of €550,000. This gain more than offsets the premium in the price per square meter.

Brand New and Fully Equipped: A completely renovated, furnished residence with a pool and parking is incomparable to a 40-year-old apartment. Rising construction costs (labor and materials) have already pushed the cost base for new construction to €3,500-4,000/m².

5.2. Capital Appreciation Estimate

The project anticipates an average annual capital appreciation of 6% - 9% over the next 5 years (2025-2030) .

Reason 1: Supply Scarcity: Conversion projects costing €250,000 are limited. Once this stock is depleted, the resale market for similar properties will be very lively.

Reason 2: Metro and Infrastructure: The expansion of the Athens Metro and the completion of the Votanikos project will transform the area into an "extension of the center".

Reason 3: Base Effect: Sepolia prices are still very low compared to the Southern Suburbs (Glyfada, Voula) or the Northern Suburbs (Kifissia). This "catch-up" effect offers a proportionally higher potential for increase.

5.3. Rental Income and Yield Analysis

Despite the short-term rental ban, the project offers competitive return rates.

Rent Estimate: In the area, rents for high-quality, furnished, and new 1+1 apartments range from €600 to €800/month, while 2+1 apartments rent from €900 to €1,200/month. In a project like 21 The Hera Athens, which includes a pool and parking, these figures are expected to be 20-30% higher (Premium Rent).

Gross Yield:

Estimated Annual Rental Income: €10,000 - €15,000

Investment Amount: €250,000 - €300,000

Gross yield will be in the range of 4.0% - 5.5%. This is above the average of 3.5%-4.5% in central Athens.

The 3% guaranteed rental income offered by the project developer creates a secure floor for investors who want to mitigate market risks (vacancy, finding tenants, etc.).

Chapter 6: Comparative Market Analysis

Feature | Sepolia (The Hera Athens) | Kypseli | Pire (Piraeus) | Southern Suburbs (Glyfada) |

Golden Visa Limit | €250,000 (Conversion) | €800,000 (Total) / €250,000 (Conversion) | €800,000 | €800,000 |

Entry Price (m²) | Medium (€4,500-€5,500) | Mid-Low (€2,500-€4,000) | Mid-High (€3,500-€5,000) | Very High (€7,000-€12,000) |

Growth Potential | Very High (Developing) | High (Near saturation) | High (Metro effect) | Medium (Saturated) |

Rental Type | Long Term (High Demand) | Short/Long Term | Long Term | Short/Long Term |

Transport | Metro (Lines 2 & 1) | Metro (Line 4 - Under construction) | Metro (Line 3) | Tram / Metro (partial) |

Neighborhood Profile | Rising Middle Class / Student | Bohemian / Multicultural | Port / Trade | Luxury / Beach |

Analysis: Sepolia offers the best price/performance ratio in terms of Golden Visa advantages and growth potential. While Kypseli is popular, Sepolia currently has superior metro connections (the Kypseli metro is under construction). Piraeus is also a strong alternative, but the "gated community/residence" concept offered by The Hera Athens is harder to find in central Piraeus.

Chapter 7: Conclusion

"The Hera Athens" is one of the projects that best understands the current legal (Golden Visa Tier system) and economic (Gentrification) conjuncture in the Athens real estate market. The project offers the investor the following three values:

Accessibility: Despite increased visa restrictions, the possibility of investing in Athens city center and obtaining EU residency from the lowest entry level (€250k).

Product Quality: A unique "residence" concept in the Sepolia region, featuring a swimming pool, parking, energy efficiency, and security.

Growth Potential: Opportunity to benefit early from the inevitable appreciation in value of the area and metro integration.

Investor Recommendation: This project is a "Strong Buy" especially for investors aiming for an EU residence permit but unwilling to tie up a large capital investment such as €800,000, and who are looking for a living and appreciating property, not an idle asset. The short-term rental ban will not affect the long-term value of the project; on the contrary, the corporate and qualified tenant profile will prevent depreciation and preserve its value.

Cited studies

Property Market Outlook for Greece, accessed December 19, 2025, https://www.amcham.gr/wp-content/uploads/2025/03/RED-H2-2024-Property-outlook-predictions-Greece.pdf

Athens Real Estate in 2025: Trends and Insights - Immigrant Invest, accessed December 19, 2025, https://immigrantinvest.com/reports/athens-real-estate-market/

Greece Real-Estate Statistics 2025 & 2026 Forecast – 50 Key Market Insights, accessed December 19, 2025, https://www.buygreece.us/greece-real-estate-statistics-2025-2026-forecast

Greece's Residential Property Market Analysis 2025, accessed December 19, 2025, https://www.globalpropertyguide.com/europe/greece/price-history

The Greek real estate market continues to show resilience and steady growth, accessed December 19, 2025, https://worldbusinessoutlook.com/the-greek-real-estate-market-continues-to-show-resilience-and-steady-growth/

Apartments for Sale Athens 2025 – Best Areas, Prices & Buying Guide - Bottom Line Property Management, accessed December 19, 2025, https://www.rentbottomline.com/blog/apartments-for-sale-athens-2025--best-areas-prices--buying-guide

Greece, accessed December 19, 2025, https://hypo.org/sites/default/files/2025-09/Greece.pdf

Greece Golden Visa 2025: Rules & Eligibility Guide - NTL Trust, accessed December 19, 2025, https://ntltrust.com/news/second-residency/greece-golden-visa-2025-investment-rules-eligibility-and-commercial-conversions/

Greece Golden Visa 2025: Commercial Conversions and Eligibility—A Counsel's Checklist, accessed December 19, 2025, https://armenian-lawyer.com/immigration/greece-golden-visa-2025-commercial-conversions-and-eligibility-a-counsels-checklist/

THE HERA ATHENS.pdf

Greece Golden Visa in 2025: how to get a residence permit by investment, accessed December 19, 2025, https://imin-caribbean.com/blog/greece-golden-visa/

Airbnb & Short-Term Rentals under Greece Golden Visa, accessed December 19, 2025, https://vistaestate.gr/2025/10/24/greece-golden-visa-short-term-rental-rules/

Hera Living @ IV8196 - Greece - Investment Visa, accessed December 19, 2025, https://www.investmentvisa.com/properties/greece/iv8196-hera-living

Athens Metro Push Toward the Coast Signals New Era for Urban Growth and Mobility, accessed December 19, 2025, https://greekreporter.com/2025/12/14/athens-metro-growth-mobility/

Athens Metro Expansion is On Track, with Future Extensions Being Prepared, accessed December 19, 2025, https://www.thenationalherald.com/athens-metro-expansion-is-on-track-with-future-extensions-being-prepared/

Athens Real Estate Surge: 27.4% Price Jump in Central Districts in Q3 2025 - Astons, accessed December 19, 2025, https://www.astons.com/news/athens-real-estate-surge-27-4-price-jump-in-central-districts/

Greek Property Prices Show No Ceiling: 38% Rise Since 2019 - GreekReporter.com , accessed December 19, 2025, https://greekreporter.com/2025/11/11/greek-property-prices-38-percent-rise-since-2019/

Athens Revamped: The Mega Projects That Could Transform the Greek Capital - GreekReporter.com , accessed December 19, 2025, https://greekreporter.com/2025/12/12/athens-projects-transform-greek-capital/

(PDF) EXPLORING THE ECONOMIC IMPACT OF THE SEASIDE URBAN REGENERATION ON SURROUNDING COMMERCIAL VALUES IN THESSALONIKI, GREECE - ResearchGate, access date December 19, 2025, https://www.researchgate.net/publication/358244957_EXPLORING_THE_ECONOMIC_IMPACT_OF_THE_SEASIDE_URBAN_REGENERATION_ON_SURROUNDING_COMMERCIAL_VALUES_IN_THESSALONIKI_GREECE

Real estate market Sepolia - Skouze - Indomio, accessed December 19, 2025, https://www.indomio.gr/en/agora-akiniton/attiki/sepolia-skouze/

What are the rental yields in Athens? - Zafido, accessed December 19, 2025, https://www.zafido.gr/what-are-the-rental-yields-in-athens/

Find homes for rent in Sepolia - Skouze - Price-reduced - Indomio.me , accessed December 19, 2025, https://www.indomio.me/en/to-rent/property/sepolia-skouze/reductions_yes

______________________________________________________________

M. Sami Akbeniz

Real Estate Investment Consultant

Urban Transformation Specialist

Avla Real Estate Inc.

Your Reliable Solution Partner

📱 +90 532 282 26 57 | +90 216 470 5381

Istanbul | Dubai | London | Athens

___________________________________

REPUBLIC OF TURKEY ISTANBUL GOVERNORATE – Directorate of Trade

MERSİS No: 0106117483200001 Authorization Certificate No: 3411699

Verification Code: f5c9C9a2-2653-4dfe-8af5-eba81cbf69d3

Address: Caferağa Mah. Şifa Sok. No:19 Kadıköy – Istanbul

Comments